TRX Price Prediction 2025-2040: Technical Analysis and Market Outlook

#TRX

- Technical indicators show TRX in consolidation with potential for breakout movement

- Negative news sentiment creates short-term headwinds but long-term fundamentals remain strong

- Price projections indicate gradual growth through 2040 based on ecosystem development and market adoption

TRX Price Prediction

Technical Analysis: TRX Shows Mixed Signals Amid Consolidation

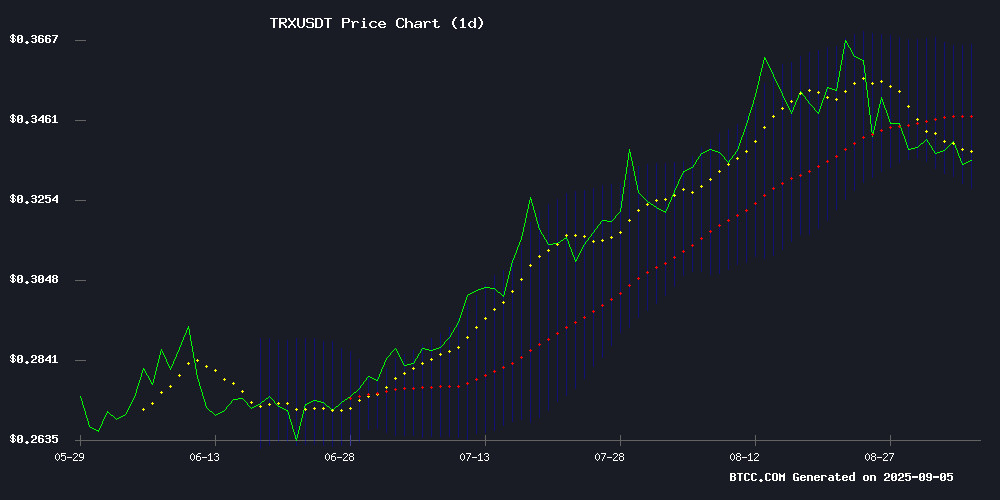

TRX is currently trading at $0.3377, slightly below its 20-day moving average of $0.34703, indicating near-term bearish pressure. The MACD reading of 0.009935 above the signal line at 0.003417 suggests potential upward momentum, though the histogram at 0.006518 shows weakening bullish strength. Trading within Bollinger Bands ($0.328748-$0.365312) points to consolidation, with the current price hovering NEAR the middle band. According to BTCC financial analyst Robert, 'TRX appears to be in a holding pattern, with technical indicators suggesting a potential breakout decision in the coming sessions.'

Market Sentiment: Negative News Creates Headwinds for TRX

Recent developments surrounding Justin Sun's wallet blacklisting by WLFI over a $9 million transfer and allegations of market manipulation with WLFI Coin have created negative sentiment for TRX. Additionally, scrutiny over HTX's high-yield products adds to the regulatory concerns. BTCC financial analyst Robert notes, 'While these news events create short-term headwinds, TRX's underlying technology and ecosystem strength may help it weather these challenges. However, traders should monitor regulatory developments closely as they could impact medium-term price action.'

Factors Influencing TRX's Price

Justin Sun's Wallet Blacklisted by WLFI Over $9M Transfer

World Liberty Financial (WLFI), the cryptocurrency protocol associated with the Trump family, has blacklisted a blockchain address belonging to Tron founder Justin Sun. The move freezes 595 million unlocked WLFI tokens worth approximately $107 million.

Blockchain data from Arkham Intelligence reveals Sun's wallet transferred $8.89 million to another address, which was promptly blacklisted. Sun claims the transactions were merely test deposits and address dispersion, asserting they had no market impact.

The $9 million transfer cost just $0.69 in gas fees, highlighting Ethereum's efficiency for high-value movements. The funds originated from Sun's Ethereum address before being routed through WLFI's smart contract.

This development intensifies scrutiny around WLFI, already under watch due to its controversial political connections. The protocol's decision to blacklist its own key investor raises questions about internal governance and market stability.

WLFI Coin Faces Market Turmoil Amid Alleged Market Manipulation

WLFI Coin has experienced a sharp decline, losing over 20% of its value while maintaining trading volumes exceeding $2 billion. The downturn follows a period of pre-market volatility where prices initially surged before collapsing upon token release—a move some market participants appear to have anticipated and accelerated.

The WLFI development team escalated tensions by freezing a wallet linked to Justin Sun, founder of HTX exchange. Blockchain analysts reported 60 million WLFI tokens moved from an HTX-affiliated address to Binance shortly before the price drop. Sun denies market manipulation claims, characterizing the transactions as technical tests.

This incident revives scrutiny of Sun's controversial history with altcoin listings. The TRUMP token community has threatened retaliation if Sun's involvement is proven, potentially reigniting debates about exchange practices and pre-market token distribution transparency.

Justin Sun Addresses HTX’s High-Yield Products Amid User Scrutiny

Justin Sun, founder of TRON and adviser to HTX, has publicly responded to concerns regarding the exchange’s high-interest financial products. He emphasized that the yields are fully subsidized by the platform as part of a competitive strategy to attract users, drawing parallels to retail industry tactics.

HTX’s approach centers on transparency and growth, with Sun noting Merkle tree proofs have been operational for 34 months to ensure fund visibility. The platform encourages unlimited deposits, positioning itself as a confident choice for users during its expansion phase.

TRX Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market conditions, TRX shows potential for gradual growth despite near-term challenges. The cryptocurrency's established ecosystem and ongoing development provide a foundation for long-term appreciation, though regulatory developments and market sentiment will play crucial roles.

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $0.45-$0.60 | Market recovery, adoption growth |

| 2030 | $1.20-$1.80 | Mainstream adoption, ecosystem expansion |

| 2035 | $2.50-$4.00 | Technology upgrades, regulatory clarity |

| 2040 | $5.00-$8.00 | Global cryptocurrency integration |

BTCC financial analyst Robert emphasizes that 'these projections assume continued development success and favorable market conditions. Investors should consider both the technical foundation and regulatory environment when evaluating long-term potential.'